Apple Removes Crypto Exchange Apps from India App Store Following Government Scrutiny

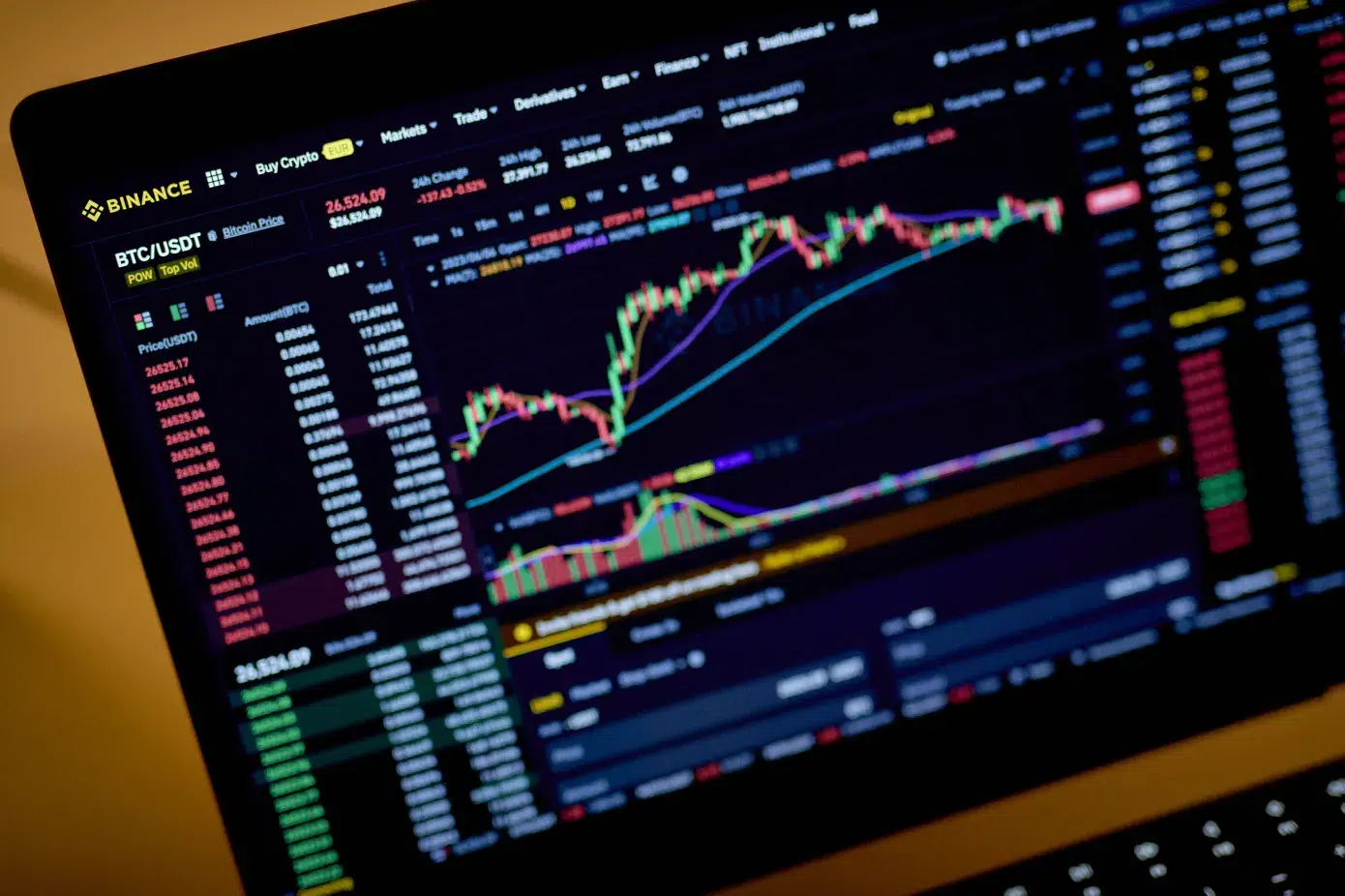

Apple Inc. has taken down the apps of at least nine cryptocurrency exchanges, including major platforms Binance and Kraken, from its App Store in India. The move comes less than two weeks after the Financial Intelligence Unit (FIU) of the Indian government flagged these global firms for allegedly operating illegally in the country due to non-compliance with anti-money laundering rules.

According to official sources, the FIU requested the Indian IT Ministry to block the websites of all nine services in the country. Other affected exchanges include Huobi, Gate.io, Bittrex, and Bitfinex. Bitstamp, another exchange named by the FIU, remains operational on the App Store, while the app of OKX has also been removed.

Notably, these apps are still listed on the Google Play Store in India and the respective websites remain accessible in the country. Users who had previously installed the apps on their devices can continue to use them.

Impact on the Crypto Market

Apple declined to comment on the matter. However, Binance sent a message to its customers in India on Wednesday, assuring them that their funds were safe. The top crypto exchange stated, “We are working hard to engage in constructive policy-making that seeks to benefit every user and all market participants. We continue to bet big on India as a leading web3 market and we are exploring all avenues to establish a long-term sustainable business in India.”

In recent quarters, many Indian cryptocurrency traders have switched to global platforms to avoid taxes. Since the introduction of a 30% tax on gains and a 1% deduction on each cryptocurrency transaction, non-compliant platforms gained popularity within India. This has affected the trading volume of local exchanges such as a16z-backed CoinSwitch Kuber, B Capital-backed CoinDCX, and former Binance partner WazirX, which require strict know-your-customer verification before onboarding new users.

Reasons for Removal and Future Implications

Ashish Singhal, co-founder and chief executive of CoinSwitch, commented on the situation: “Offshore exchanges should actively consider registering with the FIU-IND and comply with India’s AML and CFT measures. This is also better for consumer protection in India since there will be greater regulatory oversight of the ecosystem.”

CoinDCX and CoinSwitch Kuber had previously warned the Indian government that its new taxation policy would push users towards decentralized exchanges or noncompliant services. CoinDCX recently announced that it would offer rewards to customers transferring their crypto assets from global exchanges to its India-based platform.

India has historically maintained a tough stance on cryptocurrencies and the companies facilitating their trading. While the Reserve Bank of India’s ban on cryptocurrencies was eventually struck down by the Supreme Court, the central bank continues to advocate for outlawing crypto and likening virtual digital assets to Ponzi schemes.

Coinbase, another popular global cryptocurrency exchange, stopped onboarding new customers in India last year. The company’s CEO Brian Armstrong alleged that it faced “informal pressure” from the Indian central bank.

In conclusion, Apple’s move to remove major crypto exchange apps from its App Store in India highlights the ongoing tension between global cryptocurrency platforms and local regulators. While it may serve as a wake-up call for these exchanges to comply with the local regulations, it could also lead to a chilling effect on the burgeoning cryptocurrency market in the country. As the Indian government continues its efforts to regulate the industry, it remains to be seen how this clash between innovation and regulation will ultimately play out. However, one thing is for sure: the use of cryptocurrency in India is a complex issue that requires careful consideration from all parties involved.